Federal constitutional elective monarchy Population. At the time of writing the average base rates of Malaysian banks are between 175 275 pa.

How To Use A House Loan Calculator In Malaysia

Typically the bank DSR for RM5000 income is in the range of 70.

. We have the most comprehensive property listings in Malaysia for all popular property types. Home Loan Eligibility Calculator. Interest rates for home loans in Malaysia are based on Base Rates BR which lay out the minimum interest rate banks give on home loans.

What is Home Loan Eligibility. Home loan eligibility is defined as a set of criteria basis which a financial institution assesses the creditworthiness of a customer to avail and repay a particular loan amount. May 18th 2022 0 Comments.

Just provide your employment details salary current earnings and commitments and the report will provide your DSR loan breakdown and max affordability comparisons between various banks. Security Deposit equivalent to three months of monthly instalments. My Selangor Home or Rumah Selangorku provides affordable housing to those living in.

2 Including loans other than from banks. No housing loans with any financial institutions. Debt Servicing Ratio DSR is acceptable.

The moving cost included legal fees stamp duty disbursement fees and valuation fees. The actual amount may differ from customer to customer. BSN Giroi account holder.

4 The loan eligibility is only an estimate. Note 1 Minimum monthly payment. However the banks can be flexible with this in some cases.

This calculator estimates the maximum housing loan amount based on your annual income and ability to service the loan. The loan eligibility is only an estimate. Home loan eligibility depends on criteria such as age financial position credit history credit score other financial obligations etc.

As a general guideline in Malaysia you can borrow up to 30 of your gross income. Based on loan of up to 90 of property value plus 5 for MRTA financing. As long as Mary can keep the total commitments within RM3500 her loan will most probably be okay.

Zero Moving Cost Home Loan Malaysia is a home loan package where the bank absorbs all the moving costs. 278 year old Number of States. TOP 5 Tips 08022022 By Stephanie Jordan Blog.

4 Factors That Affect Housing Loan Eligibility 1. In this case RM5000 x 70 RM3500. Loan amount from RM25000 to RM300000.

According to a report one out of two housing loans are rejected in Malaysia which is no doubt a shocking statistic. And RM3500 is the amount the bank allows for Mary to have total commitments. If you make less than 30000 per year you are only permitted to have maximum liabilities that can surpass 50 of your.

Calculate and compare your home loan eligibility in Malaysia. In Malaysia the maximum loan tenure is 35 years or until the borrower turns 70 years old whichever comes earlier. Use our FREE tool to calculate and compare home loan eligibility with up to 17 banks find the lowest interest rates and check your Debt Service Ratio DSR.

Its important to note that the initial home loan repayments will primarily be used to pay down the interest on your. 3 The maximum loan tenure is 35 years or up to 70 years of age whichever earlier. That includes a new commitment and an existing one.

Home purchase for self-occupation. Zero Moving Cost Home Loan Malaysia 2022 Is this a better choice. 5 Based on loan of up to 90 of property value plus 5 for MRTA financing.

305 million Median Age. Your eligibility for a loan is determined by the amount of your monthly income less the amount of your fixed commitments. The maximum loan tenure is 35 years or up to 70 years of age whichever earlier.

Include loans other than from banks. How To Calculate Housing Loan Eligibility In Malaysia. The actual amount may differ from customer to customer.

Generally the loan tenure is dependent on your age the younger you are the longer your loan tenure. EdgeProps Loan Check makes it easier for you to know your chances on home loan approval. Our article on housing loan interest rates shows you the latest lending rates of Malaysian banks as well as a.

It implies that half the loan applicants in Malaysia are denied the chance of owning property and may have to continue renting for an extended period of time.

How Much Can You Borrow Based On Your Dsr

How To Use A House Loan Calculator In Malaysia

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

:max_bytes(150000):strip_icc()/Light_Stream_Loans-e56c203492c44dba97aa3f6842791277.jpg)

The 5 Best Motorcycle Loans For 2022

Mukhyamantri Pradhan Mantri Awas Yojana Gomati 2018 Status List Online Application Form Eligibility Required Online Application Form Status Online Application

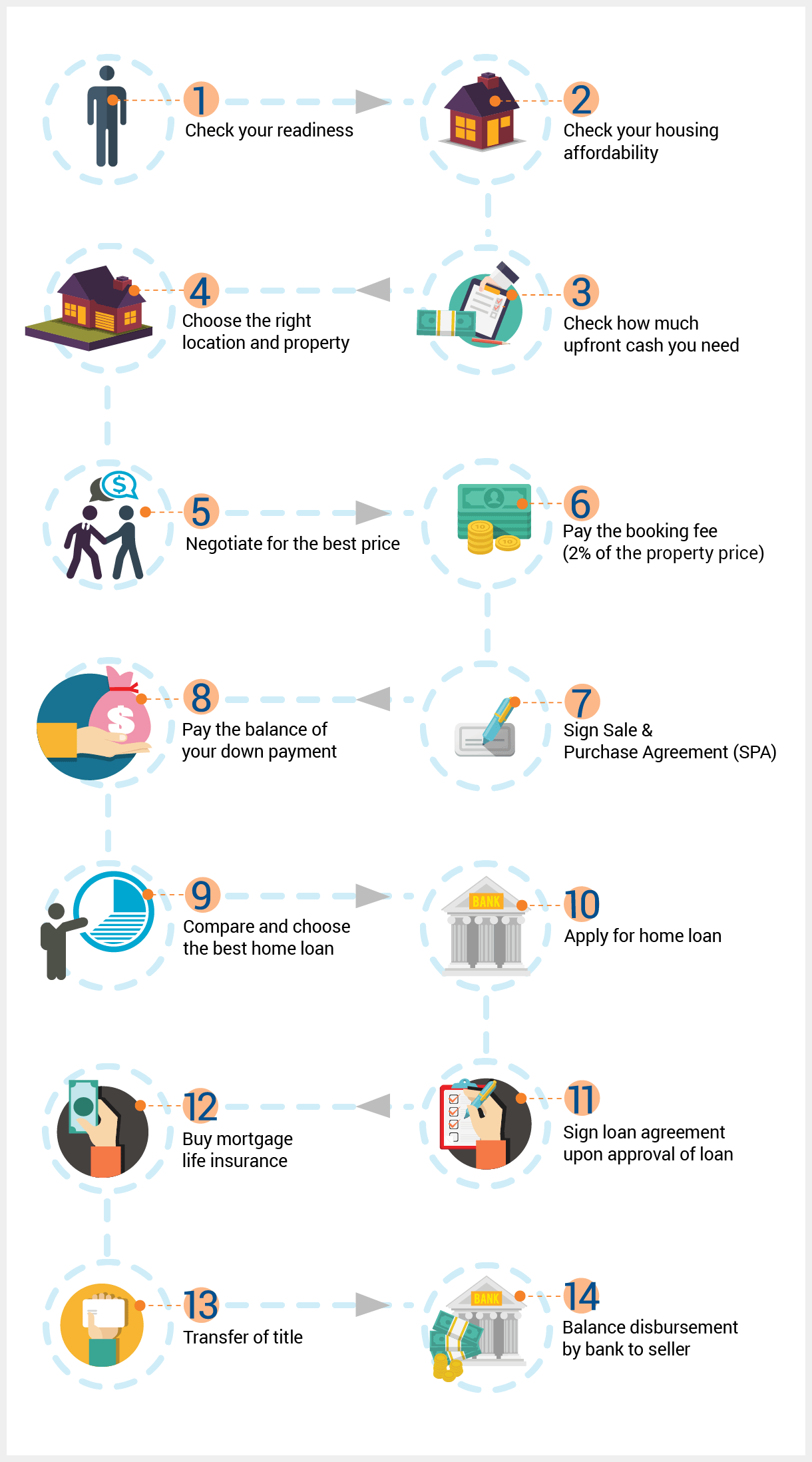

Guide To Buying Your First Home In Malaysia Visual Ly

The Future Of Eco Living In Malaysia Ecoliving Globalwarming Enviroment Property Development Info Eco Living Malaysia Eco

How To Get A Small Business Loan In 2022

How Do I Qualify For A Car Loan Experian

Home Loan For Nris In India Apply For Nri Housing Loan Hdfc Bank

You Ve Planned Every Last Detail Of Your Dream Home So Why Compromise When It Comes To Making It A Reality Sbi Now Offer Home Loans Bank Of India How To Plan

Upping Your Game Residential To Commercial Properties

Best Housing Loans In Malaysia 2022 Compare And Apply Online

Trademark Registration In Bahrain Foreigners Company Registration Trademark Registration Bahrain New Enterprise

Home Loan Apply Housing Loan Online Lowest Emi Icici Bank

Buying A Home How Much Am I Able To Borrow Home Buying The Borrowers Home Loans

Compare Apply For Loans Credit Cards And Balance Transfer Services Home Loans Balance Transfer Loan

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)